First published on VOICE in November 2020 -> Check it out here.

Anyone who has worked in Enterprise would undoubtedly have heard of or used the technology analyst firm Gartner. Firms like Gartner are famous for their research, models and IT conferences aimed at company C-Suite or Executive Leadership teams. Gartner surveys and advises 1000s of CIOs globally each year, providing research and strategy advice relating to technology, people, process, vendors and more. To many, Gartner analysts are comparable to Oracles or prediction machines, with in-depth knowledge and great wisdom. Their predictions typically come to fruition, not always precisely, but within a degree or two of accuracy.

Whatever your stance on Gartner, or similar analysts there is one certainty. Technology leaders listen to Gartner and respect their advice! The firm functions as a sounding board, saving leaders time whilst acting as an insurance policy on the future. If Gartner ticks your initiative, there’s a reasonable probability you’ll get approval, funding, and if things go south, you’re less likely to wind up unemployed. With technology leaders relying on Gartner to reduce their risk, rest assured, Gartner will take a conservative route and recommend things with a high likelihood of success (or a low chance of failure). They are unlikely to tarnish their reputation by sticking their neck out for fresh out of the gate unproven technology. They will wait for it to be proven or deemed safe for Enterprise.

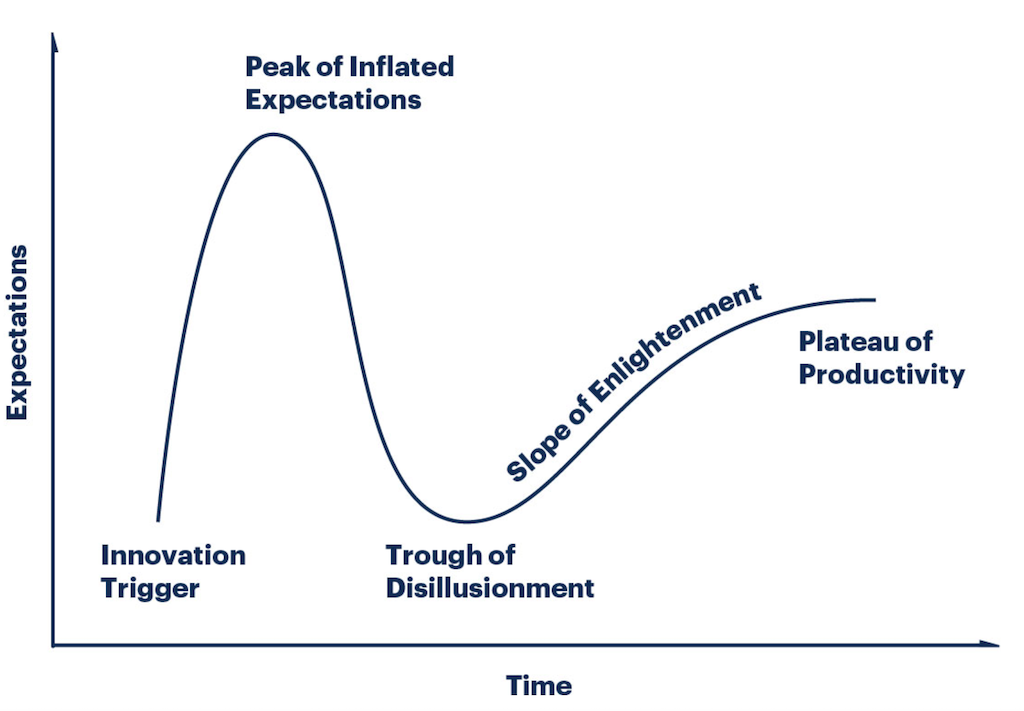

People being people, however, are frequently distracted by the shiny and new. A novel solution has an attractiveness; an allure which makes it irresistible to technology nerds alike. For this, Gartner invented the Hype Cycle. The model is their way of introducing new technologies to executives and senior leaders before having to commit. The cycle looks like this.

Source: https://www.gartner.com/en/research/methodologies/gartner-hype-cycle

“When new technologies make bold promises, how do you discern the hype from what’s commercially viable? And when will such claims pay off, if at all? Gartner Hype Cycles provide a graphic representation of the maturity and adoption of technologies and applications, and how they are potentially relevant to solving real business problems and exploiting new opportunities.”

In 2016 Blockchain technology made its debut with a 5-10 year time horizon. In recent years it has slid into the Trough of Disillusionment where it now sits. In recent times, Gartner broke Blockchain out into its individualised Hype Cycle, demonstrating just how much is currently under development.

The question is in a post COVID world, where does Gartner stand? Analyst after analyst and everyone I speak with agrees the global pandemic accelerated secular trends which before were 5-10 years out. From one day to the next, those computer bound people like myself, working from home became the norm. Video and remote collaboration became pervasive overnight.

A shift towards digitisation is no longer an option; it’s mandatory. Companies globally are working day in and out to restructure their businesses, their workforce and balance sheets to keep pace in the digital world. Those who fail to shift their revenues online risk insolvency or will flounder as the landscape gets extra choppy over the years ahead.

Analysts like Gartner had predicted Crypto and Blockchain would not reach the Slope of Enlightenment until 2025. However, have recent moves shifted the thought processes?

The chances of a company like MicroStrategy, which is Nasdaq listed, purchasing USD 425M of Bitcoin to protect its company treasury to avoid currency debasement were near zero before 2020. Or the probability of Square, the global payments provider buying USD 50M of BTC to stick on their balance sheet was low at best. Or the likelihood of Mode committing 10% of their cash reserves to Bitcoin would be improbable. The question for me is who’s next? Will Google, Facebook or another tech giant adopt the Bitcoin Standard?

In fairness to Gartner, no one predicted 2020. Now it is happening (or happened), companies are reacting and moving forward on their timelines. Recently PayPal jumped into Crypto and Blockchain by opening its merchant network to buy and sell Crypto within its system. The move brings even greater visibility and attention, making it more and more difficult for analyst firms to ignore.

This shift was further cemented by the IMF convening an online conference on Central Bank Digital Currencies (CBDCs) and a new Bretton Woods moment. Furthermore, the World Economic Forum is calling for a Great Reset, in which technology like Blockchain is at the centre of its master plan.

How about Google, one of the world’s largest tech companies becoming a Block Producer candidate on the EOS Public Blockchain.

Blockchain and Cryptocurrency advocates understood the value of the technology years ago, and now the world is embracing and catching up. Institutions and significant investors are coming. The case for Bitcoin as a Life Raft from the current monetary system was made by Raoul Pal, the founder & CEO of Real Vision.

Tech analysts can no longer ignore Crypto and Blockchain.

Now for a prediction of my own. I think Gartner and analyst firms alike, will begin recommending CIOs and Executive Leaders of Enterprise companies move Blockchain projects out of Proof of Concept to full development in 2021. The pandemic has accelerated many slow-moving trends, in some cases transporting us forward years in only a few short months.

A recent Gartner survey suggested two-thirds of ANZ CIOs are uninterested in Blockchain. On the flip side, around 40 per cent have an interest, and if firms like Gartner recommend in earnest, it’s likely to drive enterprise confidence and adoption higher. I can’t wait to see how things progress.

Stay tuned for more Enterprise focused Blockchain content.